With the announcement of a 1.2% increase in employer National Insurance (NI) contributions, set to push rates to 15% starting April next year, UK businesses face a pivotal moment. This rise, combined with the threshold drop from £9,100 to £5,000 at which Employers NI contributions kick in, means that businesses will soon feel an immediate and tangible impact on hiring costs. While small businesses are partly shielded through a doubled employment allowance of £10,500, this shift signals a clear call to rethink traditional hiring strategies—and it’s here that the self-employed workforce offers a smart, flexible solution.

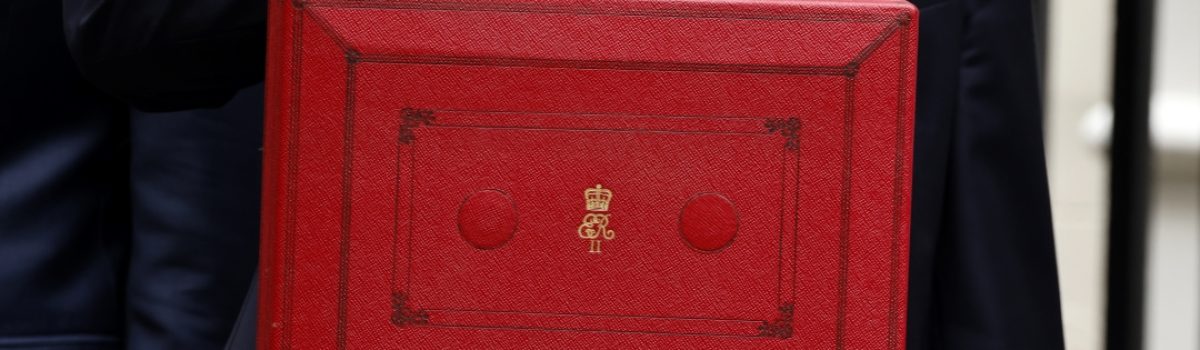

Chancellor Rachel Reeves acknowledges the tough choice behind the NI increase, emphasising the need for strong public finances to support essential services like the NHS and education. However, this decision also opens a new dialogue around hiring costs and the strategic advantages of working with self-employed professionals.

Rising Hiring Costs and the Pivot to Self-Employment

In industries such as construction, where flexible, project-based work has been commonplace, leaders are already adapting to increased costs by turning to self-employed talent. Rising employer NI could catalyse a broader shift to the self-employed model. Beyond construction, other sectors too can use the flexibility, ability, and cost-efficiency that the self-employed bring.

Instead of paying added NI costs on salaried employees, using sole traders and freelancers presents a more agile, cost-effective solution. When hired on a project or contract basis, self-employed professionals provide their own NI coverage, relieving employers from increased taxation burdens. This shift allows companies to still be nimble, quickly scaling up or down according to business needs without incurring traditional employment taxes.

Key Benefits of a Self-Employed Workforce

- Cost Efficiency: Without employer NI on their wages, hiring self-employed professionals significantly reduces costs. This approach allows small businesses to keep their budgets lean while securing specialized skills on an as-needed basis.

- Adaptability: As economic conditions change, businesses require flexibility. With the freedom to adjust team sizes as needed, hiring self-employed talent allows companies to respond dynamically to market shifts, keeping overheads low.

- Specialised Skill Access: The self-employed talent pool includes experienced professionals across industries. From tech to design to consulting, businesses gain access to experts without long-term commitments.

- Minimised Administrative Burden: Employing self-employed professionals often reduces paperwork and payroll management, allowing organisations to focus resources on core business operations rather than administrative tasks.

Action Points for Businesses

- Evaluate Your Hiring Needs: Consider whether certain roles would be more cost-effective if filled by freelance or contract workers, especially given the NI increase.

- Review Employment Status Compliance: As businesses shift toward self-employed engagement, it’s crucial to ensure compliance with employment tax laws and accurately assess worker status to avoid unforeseen tax implications.

- Leverage the Employment Allowance: Smaller businesses employing traditional staff can still receive help from the increased employment allowance, covering four full-time workers at the national living wage without incurring NI costs.

Conclusion

Amid rising employer costs, businesses are wise to explore the self-employed workforce as a practical, strategic hiring solution. By using contractors, sole traders, and freelancers, companies can keep budget control, access specialised ability, and keep the agility needed to thrive in a competitive market.

The Guild is here to help you navigate these changes and thrive.

Let us handle the complexities of workforce management, tax, and compliance, so you can focus on what you do best – building the future.

Trust the Guild – where compliance isn’t just a promise, it’s a guarantee.

Choose The Guild and secure your peace of mind.

Book a quick call with our experts!

Our experts are happy to offer tailored advice for your business, unriddle any confusion about tax law and explain the amazing savings you could make.